In this guide...

- Setting up Simplero to Collect Tax for You

- Overriding Taxes at the Product Level

- Taxes in different subregions (states, provinces, etc)

- Taxes on multiple currency products

- Prevent Sales from a Specific Country

Setting up Simplero to Collect Tax for You

-

Select Settings from you Simplero Dashboard

-

Select the Taxes tab under Sales

-

Set your Home country and enter the Tax percent when editing and showing prices (If you are unsure what tax rate is being charged you can scroll to the bottom and see a listing of all countries and Tax Rates and even add a new one if needed. )

-

Select your Tax strategy. You will see three options:

-

No tax

-

Simple tax - use this if you're based outside the EU—we'll still add EU VAT when relevant

-

EU/UK VAT - use this if your business is based inside the EU or the UK. The EU/UK has particularly complex rules about when to apply taxes and when not to, depending on where the course is taking place or whether or not customers supply a valid EU/UK VAT number. Unsure how to set your taxes up to comply with EU VAT? Take a look at this guide

-

- Choose if you want your customers to choose their own country, or if you want it to be automatically set based on their IP address. It is important to note that the IP address method is not 100% reliable, and it's a bummer for them if they're traveling while purchasing from you, but it can help prevent unwanted sales to the EU.

-

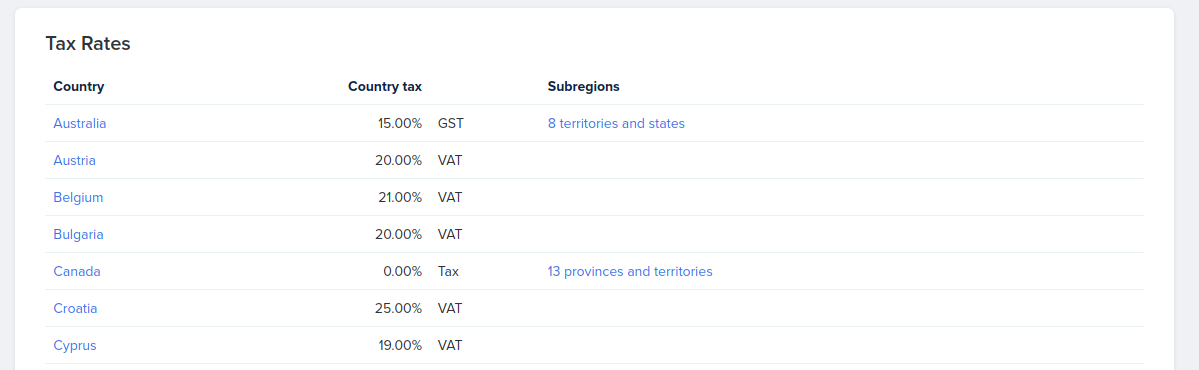

Review the taxes per country (if necessary). We have the VAT rates, as we know them, for each EU member country, loaded from the start in your settings - taxes page but you can edit them if you notice they are not correct.

- Click the Save changes button

Note: Choose Rest of the World if you want to define taxes for all the countries that are not added. You can also use prevent sales to customers in this country to stop sales from any countries that are not on the list.

Overriding Taxes at the Product Level

Sometimes you might need to set custom tax rates that override the account's rate settings for that region.

-

Navigate to the Product - Configure tab.

-

Scroll down to the tax settings section and look for the button "Per-country overrides" on the left sidebar:

-

Enter the new value on the Empty boxes or click on Apply to set up the suggested value :)

-

Add any additional countries at the bottom of the page.

The values auto-save as soon as they get added, no need for further "Save" steps on this page! :)

Taxes in different subregions (states, provinces, etc)

It is also possible to define different tax rates for different states or provinces. You can find this by following these steps:

-

Select Account Settings from your Simplero Dashboard

-

Select the Taxes tab

-

Enable taxes by choosing one of the options in the 'Tax strategy'.

-

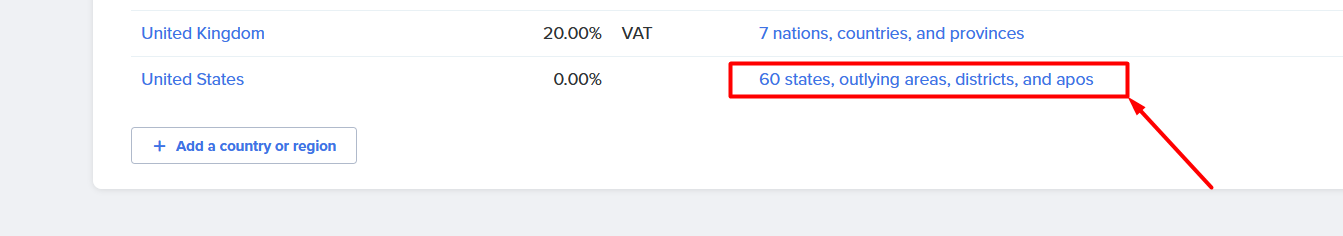

Scroll all the way to the bottom till you find the country you wish to edit and then click on the subregions:

-

You can then edit tax rates for every state/province/region separately

Note! If you need help handling your taxes in the US, you can use our TaxJar Integration.

Taxes on multiple currency products

Simplero will determine the tax based on your client's location. So if they are in the US, it will charge the US currency and tax, and if they are in Canada, it will charge the Canadian dollar and tax rate.

The percentage will be based on their location regardless of the currency.

Prevent Sales from a Specific Country

If you want customers from specific countries not to be able to purchase from you, you can do that from the tax settings. As an example, this can be used to deny customers in the EU to avoid the hassle of the EU VAT for non-EU providers.

-

Select Settings from your Simplero Dashboard

-

Select the Taxes tab under Sales

- Scroll down to review the tax rates. Choose the country from the list or add it if needed.

- Choose the setting to prevent sales to customers in this country.

Note: If you want to allow sales only in some countries, add those countries to the list and then choose Rest of the world and turn the prevent sales to customers in this country setting ON.